The landscape of crypto trading is evolving rapidly, shaped by both technological innovation and the growing participation of retail investors. While crypto trading bots aren’t new and have existed for over a decade, the increasing demand for them is shifting expectations: traders now want platforms that are not only powerful and flexible but also intuitive and accessible. In this blog, we’ll explore how trading bots are changing, why user experience matters more than ever, and what traders should look for in a modern crypto platform.

The Double-Edged Sword of AI-Powered Crypto Trading Bots

It’s no secret that the coming years will bring even deeper integration of AI into crypto trading bots. Today, many platforms already use AI to optimize trading strategies and fine-tune indicator settings. This sounds promising, but it raises a big question: how can we be sure we’re not just overfitting strategies to historical data — creating bots that look great in backtests but fall short in live markets?

AI shines when it comes to processing huge amounts of data quickly. It can uncover patterns and generate signals that would take humans hours or even days to find. But this power comes with its own challenges. Sometimes, AI systems “hallucinate” or misinterpret what they see, especially if the data they’re fed is biased or incomplete. That’s why it’s crucial not to rely on AI as an all-knowing assistant that autonomously changes your trading strategy, especially when it handles your money. Instead, consider using AI as a separate layer of confirmation — a tool to verify contextual information, not drive the strategy execution for you.

Looking ahead, AI could play a huge role in turning social sentiment, breaking news, or even tweets from influential government officials into actionable insights. The real key is to balance AI’s strengths with solid human oversight and robust risk management. That way, your trading strategies stay both adaptive and resilient, ready for whatever the real world throws at them.

Customization at the Cost of User Experience

As retail interest in cryptocurrencies grows, crypto trading bots must evolve to offer a better user experience. Many existing bots are overly complex — not out of necessity, but because they were originally designed as “choose your strategy and run” platforms. This approach worked during bullish markets, but it often led users to confuse luck with effective strategy. Now, as users demand more customization, most bots respond by piling on features like stop-loss, profit-taking, and notifications on top of running the strategies. Unfortunately, these additions often result in cluttered interfaces and overwhelming configuration options, making the platforms difficult to use.

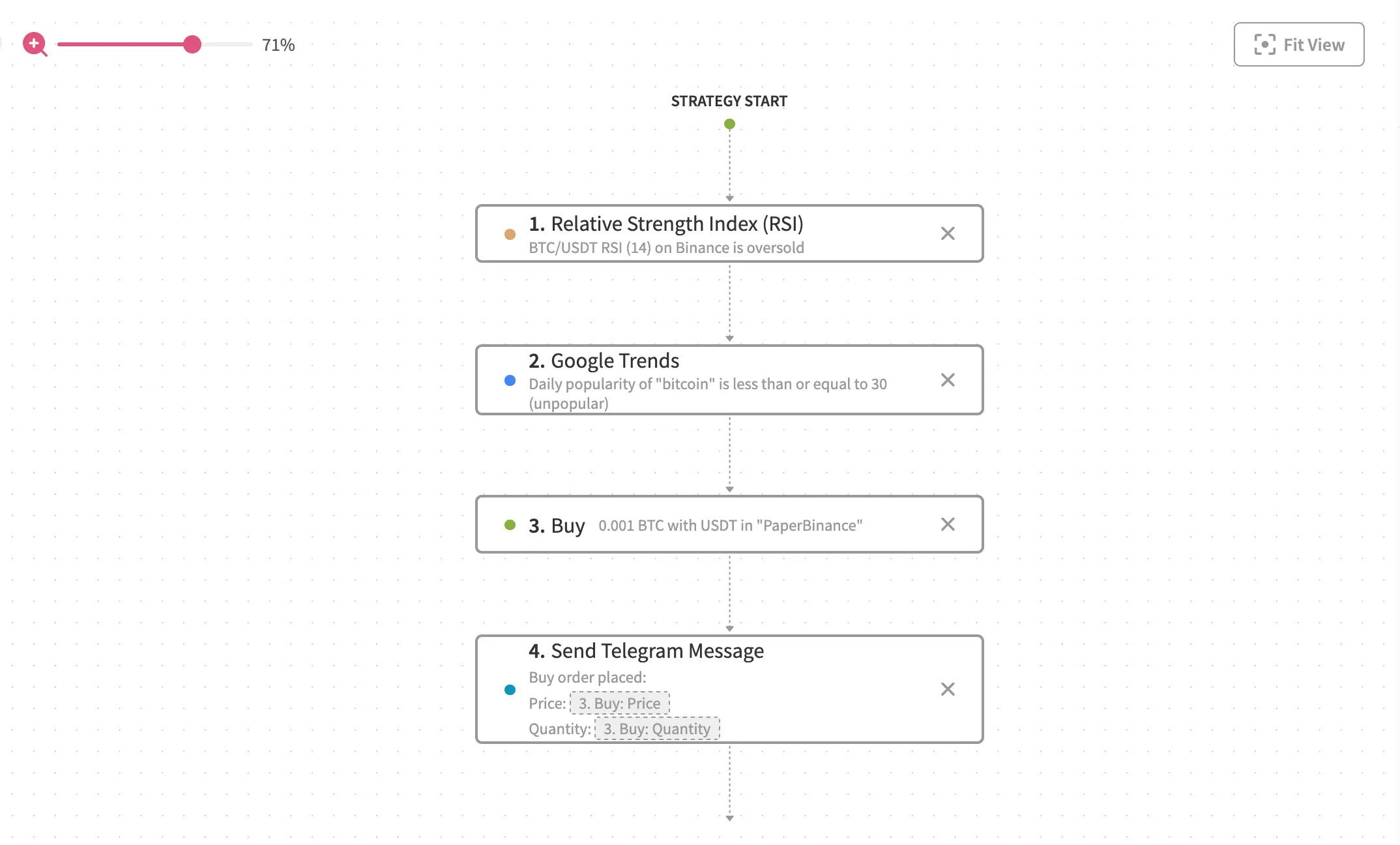

Some bots try to solve this by letting users inject custom code, but this solution is inaccessible to most and encourages advanced users to build their own tools instead. The better path forward is to rethink strategy building design from the ground up: strategies should be simplified into clear, interchangeable actions and conditions, with essential features like stop-loss being a strategy building component — not as an external add-on. By focusing on intuitive, integrated design, trading bots can become both powerful and user-friendly, meeting the needs of a broader retail audience.

Analytics & Clear Strategy Performance Overview

Continuous monitoring is essential for any investment strategy to ensure it operates as intended. Modern crypto trading strategies often rely on multiple conditions before executing trades, and a single faulty parameter can undermine the entire strategy. While paper trading offers a valuable way to test strategies before going live, it typically provides only basic dashboards with profit and loss charts, which rarely deliver a comprehensive view of strategy performance.

To truly empower users, every strategy execution should be fully transparent — detailing all computations, input data, and decisions. Making this information accessible not only helps users refine and optimize their strategies but also builds trust in the platform. For example, let’s take the previously mentioned AI decision feature: users need clear feedback on what the AI interpreted and how it reached its conclusions, but AIs are infamous for being “black boxes” when it comes to decision-making. Without this transparency, it becomes impossible to determine whether AI is enhancing or hindering the strategy as its output is not something that we can properly measure.

Why Jellydator Isn’t Just Called a Crypto Trading Bot

In recent years, the crypto space has matured significantly and is no longer viewed as a short-lived experiment doomed to fail. Cryptocurrencies are now widely recognized and adopted as legitimate financial instruments by governments, institutional funds, private companies, and retail traders alike. Regardless of your profession or interests, the growing influence of crypto on the global economy is undeniable. Staying uninformed or disengaged from this rapidly evolving sector could mean missing out on valuable opportunities — or even losing money — as digital assets become an integral part of the world’s financial landscape. While Jellydator provides all the essential tools to build and automate crypto trading bots, its vision extends beyond simple price tracking automation. The platform is designed for tracking and analyzing news, social media sentiment, Google search trends, and other market signals, enabling users to stay fully informed in the fast-moving crypto space. In 2025, being just a crypto trading bot that tracks prices is no longer enough — traders need integrated analytics and real-time social insights to remain competitive and capitalize on emerging opportunities.

Conclusion

The future of crypto trading platforms lies in their ability to seamlessly blend advanced technology with user-centric design. As AI and automation become more deeply integrated, the most successful platforms will be those that prioritize transparency, intuitive strategy building, and comprehensive analytics — empowering traders of all experience levels to make informed decisions. By moving beyond basic automation and embracing real-time insights from diverse data sources, platforms like Jellydator are setting a new standard for what it means to trade and invest in the digital asset era. The next generation of crypto tools will not just execute trades — they will inform, adapt, and support users in navigating an increasingly complex financial landscape.