In our previous blog post on dollar-cost averaging (DCA),

we explained what DCA is, discussed its widespread popularity, and

highlighted the limitations investors encounter when using built-in

recurring buying or DCA features on exchanges. To address these

limitations, tools like Jellydator come into play, enabling investors to

customize their strategies to better align with their individual goals.

In this guide, we will show you how to create a DCA strategy with your

own custom schedule by using the Date & Time Jellydator step.

Building Custom DCA Schedule

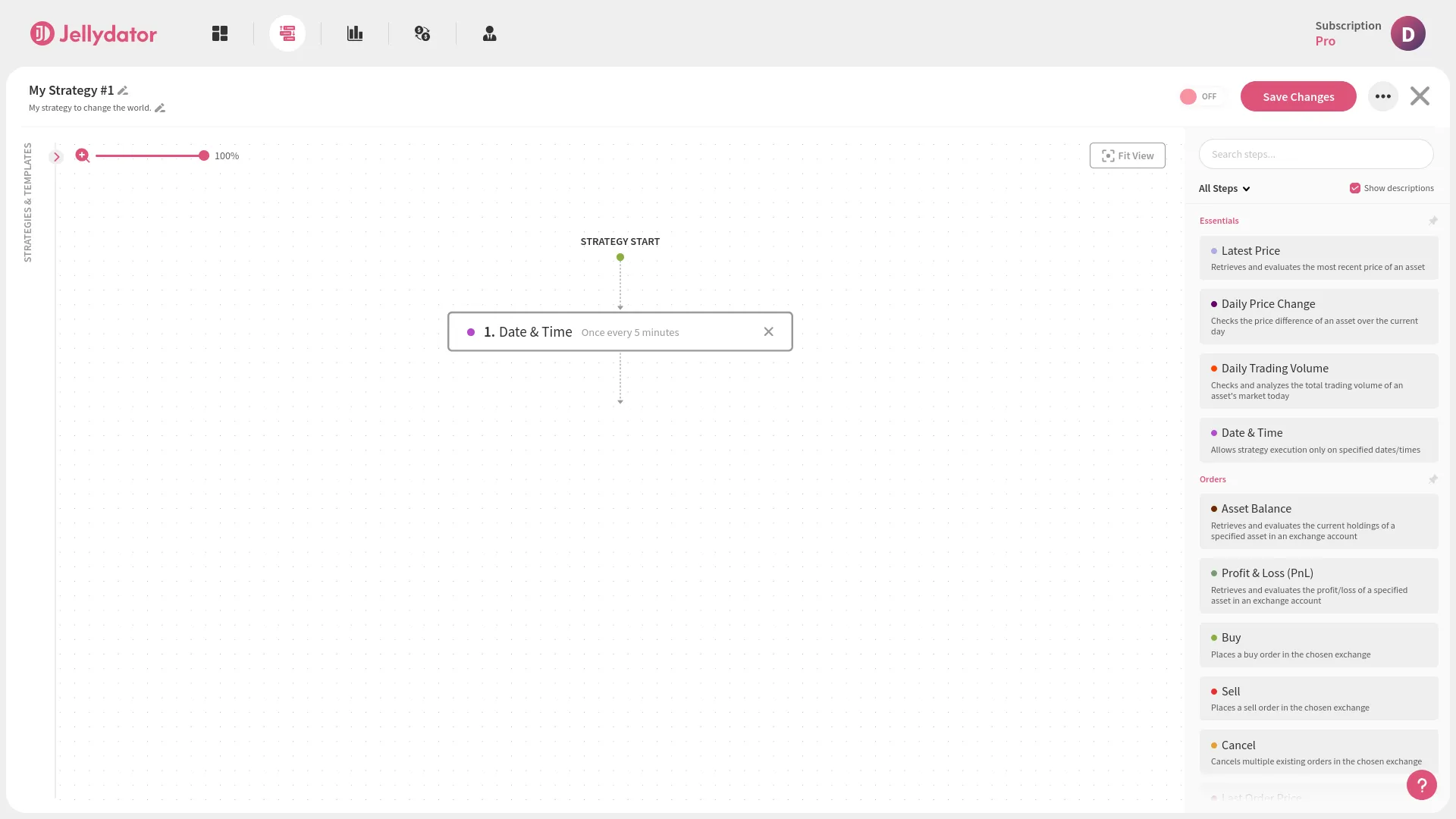

To begin, navigate to the strategy page (app.jellydator.com/strategies)

and click “Create Strategy” to ensure you are working with a blank setup.

Insert the Date & Time block as your first step, then click on it within

the strategy editor to access its configuration options.

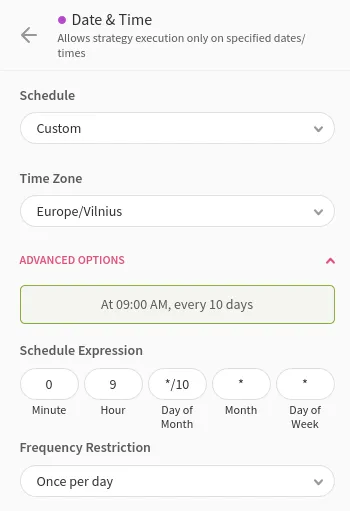

The platform provides a variety of predefined scheduling choices, such as

“every day”, “Monday through Friday”, or “weekends only”, which you can

select from the “Schedule” dropdown menu. If none of these options meet

your needs, you can define a completely custom schedule using schedule

expressions. These expressions use a syntax based on the widely adopted

Cron format. While Cron expressions may seem complex at first, visual tools

and reference lists are available

online to help you build your desired schedule. For example, to schedule

an action at 9:00 AM every 10 days, you would use the following Cron

expression: 0 9 */10 * *.

Lastly, you might want to make sure an action doesn’t happen too often. For example, maybe you want something to run just once during a certain period, but it doesn’t matter exactly when. The problem is that Cron schedules need you to pick exact times or time ranges for things to happen, so you can’t easily set it to “run once at any time in this period.” For this, a frequency restriction should be used, which has options like “Once per day”, “Once per week” and others, to limit the schedule.

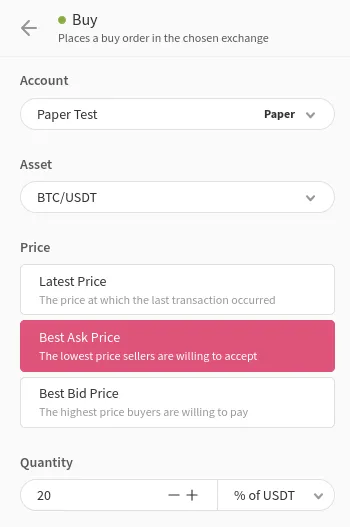

And with that, over 50% of the strategy is complete. The next step is

to add a Buy action, which will place an order for your chosen asset.

Locate the Buy step in the right sidebar and drag it to the designated

placeholder in the strategy editor. Then, click on the Buy block to

configure its settings.

Now, all you have to do is specify the account and asset you wish to purchase, choose the price type to be used, and enter the quantity.

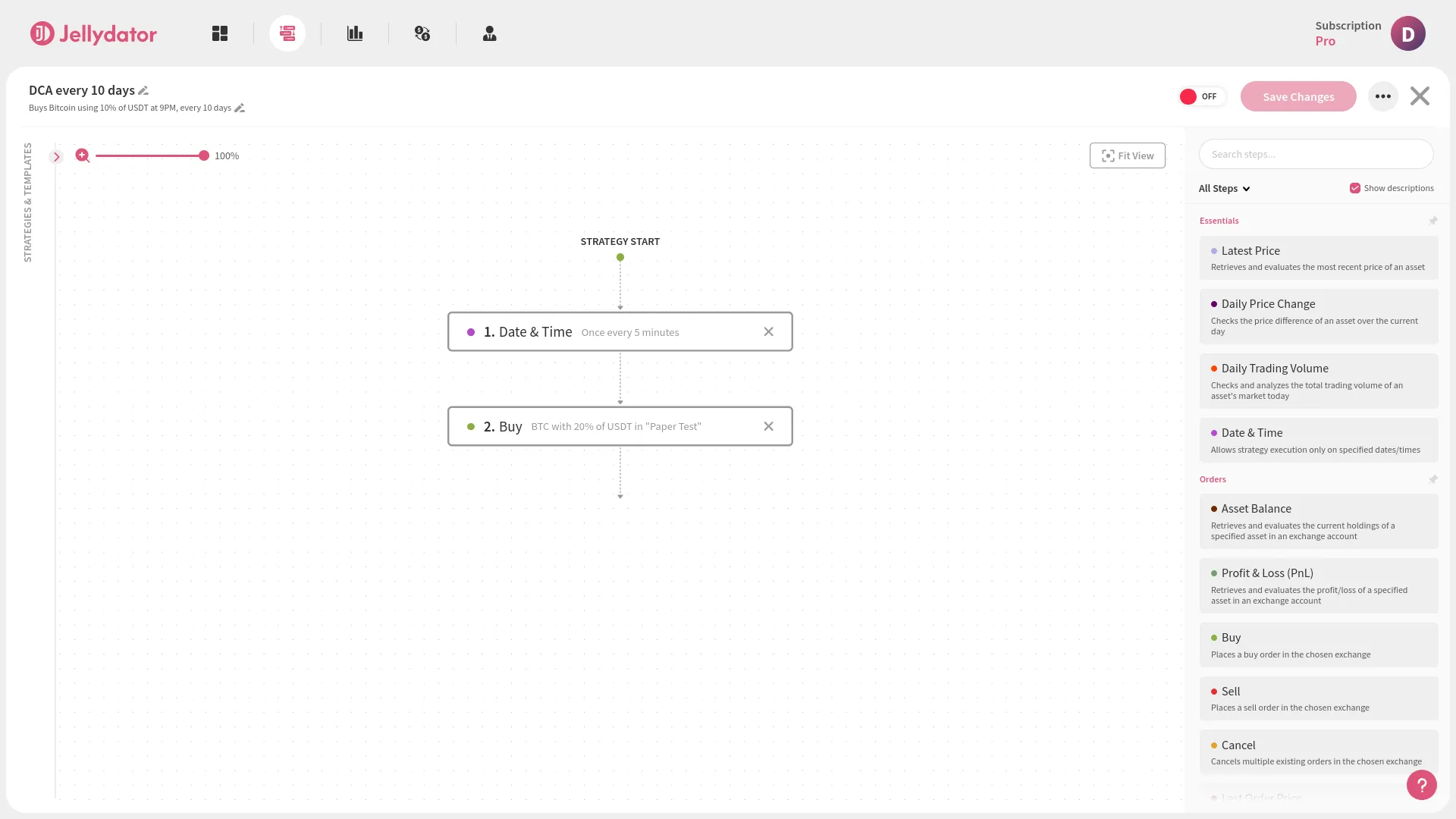

Once you have finished configuring your strategy, be sure to give it a clear name and provide a description. After saving, activate your strategy by clicking the red “off” toggle button to switch it to “on.” This will start the strategy.

Conclusion

By leveraging Jellydator’s customizable scheduling features, investors can break free from the rigid timing restrictions imposed by most other bots and exchange-based dollar-cost averaging (DCA) tools. Platforms like Jellydator empower users to design DCA strategies that truly fit their individual needs — whether that means investing on a unique schedule, using advanced time expressions, or simply streamlining the process through an intuitive strategy editor.

With just a few straightforward steps — setting a personalized schedule and configuring your buy actions — you can automate a DCA strategy that aligns with your goals and preferences.

In summary, building a custom DCA strategy enables you to:

- Move beyond standard daily, weekly, or monthly intervals with fully tailored schedules.

- Simplify and automate your investment process using user-friendly tools.

- Ensure your strategy is flexible enough to adapt as your goals or market conditions change.